Why Specialists Will Win the Next Decade of Venture

Venture’s Next Best Firms Won’t Be Generalists

Scott Kupor, Andreessen Horowitz: “The 'Generalist Model' is dead.”

Specialists vs. generalists—a debate at the heart of VC. In the early days of venture, all firms were generalists by default. The asset class was yet to stand on its own two feet, and raising a fund was challenging enough without narrowing a thesis to a specific sector or geography.

Fast forward to today, and this choice has become one of the biggest decisions for both emerging and established funds. As we head into the next cycle of VC vintages, specialisation is necessary to outperform—can generalists keep up?

Listen to the Data

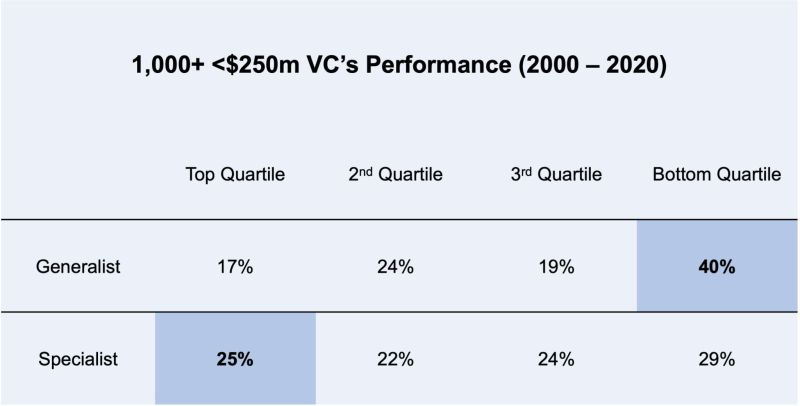

Let’s look at PitchBook’s analysis of 1,306 VC funds to provide the data-led lens of the specialist vs. generalist debate. At first glance, the results seem straightforward. Among funds under $250 million, specialists have consistently outperformed generalists on a median IRR basis for the last 20 years (2020-2025 are excluded since funds are still deploying).

But here’s where they got it wrong: the median was used as the benchmark. In venture, median returns are not worth the illiquidity risk profile. Better performance can be found in public market investing and other private alternatives. If you’re not hitting top-quartile performance, you might as well put your money somewhere else. That’s why we, as allocators, must focus on the best-performing funds.

Specialists Are 47% More Likely to Be Top Quartile

Let’s focus on what really matters: top-quartile performance. Using the same PitchBook dataset, specialist VCs increase the probability of a top-quartile outcome by 47%. Generalist allocations also significantly increase the risk of landing in the bottom quartile—a death sentence for any allocator.

For LPs, the implications are clear: backing specialists is a performance-driven necessity.

Make Your Case: Generalists vs Specialists

Generalist funds have been the go-to model for a long time, and it makes sense. The risk is spread across various industries, so if one area takes a hit, the whole portfolio doesn’t suffer. Diversification can help smooth out returns over time and give the flexibility to chase new opportunities—crypto yesterday, AI today, and ‘let’s see’ tomorrow. They can move where the action is, which can be an advantage in a fast-changing market.

However, flexibility has its downsides. Generalists risk chasing trends and paying a premium for them. Without deep conviction or domain expertise, generalists can be drawn into hype cycles—often overpaying for access after others have invested in the best opportunities.

In a world where technology is evolving at the fastest speed we have ever seen, the ‘jack-of-all-trades, master-of-none’ approach is becoming increasingly fragile.

Specialist firms have one big advantage: depth. When your thesis is laser-focused, you’re more likely to spot the real outliers early—before the noise kicks in and the price tags skyrocket. And if you’re right? The upside is exactly what LPs should be chasing—a 47% higher chance of landing in the top quartile. Of course, specialisation has its risks—if the sector struggles, so does the fund. But that’s the game. Instead of relying on generalists to cover everything, LPs should manage risk by spreading allocations across multiple specialists.

Why Specialisation Matters More Than Ever

In a bull market, generalists can thrive. Capital is abundant, and the game is often about access rather than insight. But in today’s market, understanding at a deeper level is more important than ever.

Venture is increasingly turning (back) to funding science-driven and technically complex companies. It requires deep sector knowledge, not just financial pattern-matching. Generalists will either struggle to assess these opportunities, pay a premium or rely on good old fashioned ‘luck’.

2025 is shaping up to be an inflexion point for contrarian thinkers. True conviction comes from going deep into a rabbit hole. Walk one path and understand it instead of trying to walk ten different paths at once.

Historically, the best-performing company in a given year hasn’t come from the hottest sector. The biggest returns come from looking where others aren’t. Pick a lane and own it—or risk being left behind.

This is great. Is there a fund size where generalists start to perform better?

What LPs actually want is consistent, net cash-on-cash returns that BEAT the asset class, and a high probability the fund survives, scales, and returns capital in a reasonable time.

Quartile rankings are a relative performance measure. They tell you, “How did this fund do compared to other survivors,” not whether it delivered absolute returns or even avoided failure.

For sub-$250M funds, where over half never raise a second fund, this framing is dangerously incomplete.

Saying “specialists are more likely to be top quartile” ignores the fact that 29% still end up in the bottom.

This chart excludes the many dead funds that didn’t even make the quartile cut.

LPs should care more about the base rate of survival, DPI, and whether the strategy has a durable edge than where it sits on a survivorship-skewed ladder. Any analysis that omits failure data is not insight. This crap is marketing.